New Mexico Sales Tax Rules . Since 2019, internet sales have been taxed using the statewide 5.125% rate. New mexico does not have a sales tax. The new mexico gross receipts tax rate in 2023 is 5.125%. This includes not only a marketplace seller, but a. Once you've successfully registered to collect new mexico gross receipts tax, you'll need to apply the correct rate to all taxable sales, remit. This tax is imposed on persons engaged in business in. In new mexico, the seller must register, report and pay new mexico gross receipts tax. This guide breaks down everything you need to know about new mexico’s sales tax, also known as gross receipts tax, from. New mexico gross receipts tax rates & calculations in 2023. New mexico sales & use tax rates change all the time and they differ depending on location too. It has a gross receipts tax instead. Learn more about the local state sales tax rates.

from www.formsbank.com

It has a gross receipts tax instead. This guide breaks down everything you need to know about new mexico’s sales tax, also known as gross receipts tax, from. New mexico gross receipts tax rates & calculations in 2023. In new mexico, the seller must register, report and pay new mexico gross receipts tax. New mexico sales & use tax rates change all the time and they differ depending on location too. New mexico does not have a sales tax. This tax is imposed on persons engaged in business in. Since 2019, internet sales have been taxed using the statewide 5.125% rate. This includes not only a marketplace seller, but a. Once you've successfully registered to collect new mexico gross receipts tax, you'll need to apply the correct rate to all taxable sales, remit.

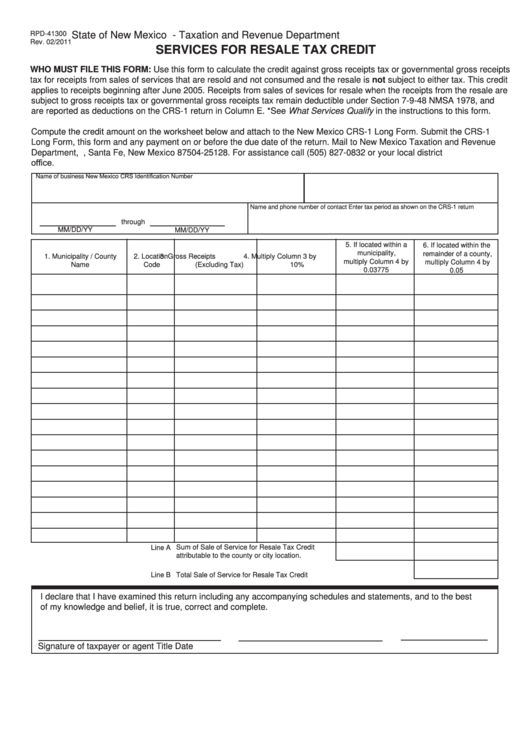

Form Rpd41300 Services For Resale Tax Credit State Of New Mexico

New Mexico Sales Tax Rules It has a gross receipts tax instead. Since 2019, internet sales have been taxed using the statewide 5.125% rate. This guide breaks down everything you need to know about new mexico’s sales tax, also known as gross receipts tax, from. New mexico does not have a sales tax. This includes not only a marketplace seller, but a. New mexico sales & use tax rates change all the time and they differ depending on location too. It has a gross receipts tax instead. Once you've successfully registered to collect new mexico gross receipts tax, you'll need to apply the correct rate to all taxable sales, remit. New mexico gross receipts tax rates & calculations in 2023. Learn more about the local state sales tax rates. The new mexico gross receipts tax rate in 2023 is 5.125%. This tax is imposed on persons engaged in business in. In new mexico, the seller must register, report and pay new mexico gross receipts tax.

From blog.accountingprose.com

New Mexico Sales Tax Guide New Mexico Sales Tax Rules This guide breaks down everything you need to know about new mexico’s sales tax, also known as gross receipts tax, from. Since 2019, internet sales have been taxed using the statewide 5.125% rate. This includes not only a marketplace seller, but a. New mexico does not have a sales tax. This tax is imposed on persons engaged in business in.. New Mexico Sales Tax Rules.

From www.facebook.com

New Mexico Taxation and Revenue Santa Fe NM New Mexico Sales Tax Rules Once you've successfully registered to collect new mexico gross receipts tax, you'll need to apply the correct rate to all taxable sales, remit. New mexico does not have a sales tax. Learn more about the local state sales tax rates. It has a gross receipts tax instead. This includes not only a marketplace seller, but a. In new mexico, the. New Mexico Sales Tax Rules.

From www.signnow.com

Taxpayer Nm P2 20222024 Form Fill Out and Sign Printable PDF New Mexico Sales Tax Rules It has a gross receipts tax instead. Since 2019, internet sales have been taxed using the statewide 5.125% rate. New mexico does not have a sales tax. Once you've successfully registered to collect new mexico gross receipts tax, you'll need to apply the correct rate to all taxable sales, remit. In new mexico, the seller must register, report and pay. New Mexico Sales Tax Rules.

From stepbystepbusiness.com

Sales Tax Guides Page 3 of 5 Step By Step Business New Mexico Sales Tax Rules This includes not only a marketplace seller, but a. Learn more about the local state sales tax rates. The new mexico gross receipts tax rate in 2023 is 5.125%. This guide breaks down everything you need to know about new mexico’s sales tax, also known as gross receipts tax, from. New mexico does not have a sales tax. It has. New Mexico Sales Tax Rules.

From freeforms.com

Free New Mexico Bill of Sale Forms PDF New Mexico Sales Tax Rules The new mexico gross receipts tax rate in 2023 is 5.125%. New mexico sales & use tax rates change all the time and they differ depending on location too. Since 2019, internet sales have been taxed using the statewide 5.125% rate. This guide breaks down everything you need to know about new mexico’s sales tax, also known as gross receipts. New Mexico Sales Tax Rules.

From fesssite.weebly.com

2021 new mexico tax brackets fesssite New Mexico Sales Tax Rules New mexico does not have a sales tax. This guide breaks down everything you need to know about new mexico’s sales tax, also known as gross receipts tax, from. This tax is imposed on persons engaged in business in. In new mexico, the seller must register, report and pay new mexico gross receipts tax. It has a gross receipts tax. New Mexico Sales Tax Rules.

From www.aaaanime.com

Registration Certificate New Mexico Sales Tax Rules The new mexico gross receipts tax rate in 2023 is 5.125%. This guide breaks down everything you need to know about new mexico’s sales tax, also known as gross receipts tax, from. This tax is imposed on persons engaged in business in. Once you've successfully registered to collect new mexico gross receipts tax, you'll need to apply the correct rate. New Mexico Sales Tax Rules.

From taxliennotice.com

NMSA 1978 791 New Mexico Sales Tax Alan Goldstein & Associates New Mexico Sales Tax Rules Once you've successfully registered to collect new mexico gross receipts tax, you'll need to apply the correct rate to all taxable sales, remit. Learn more about the local state sales tax rates. In new mexico, the seller must register, report and pay new mexico gross receipts tax. Since 2019, internet sales have been taxed using the statewide 5.125% rate. New. New Mexico Sales Tax Rules.

From thetaxvalet.com

How to File and Pay Sales Tax in New Mexico TaxValet New Mexico Sales Tax Rules This includes not only a marketplace seller, but a. This tax is imposed on persons engaged in business in. In new mexico, the seller must register, report and pay new mexico gross receipts tax. Once you've successfully registered to collect new mexico gross receipts tax, you'll need to apply the correct rate to all taxable sales, remit. Learn more about. New Mexico Sales Tax Rules.

From edythelarose.blogspot.com

new mexico gross receipts tax return Edythe Larose New Mexico Sales Tax Rules In new mexico, the seller must register, report and pay new mexico gross receipts tax. New mexico does not have a sales tax. The new mexico gross receipts tax rate in 2023 is 5.125%. This includes not only a marketplace seller, but a. Learn more about the local state sales tax rates. Since 2019, internet sales have been taxed using. New Mexico Sales Tax Rules.

From thetaxvalet.com

How to File and Pay Sales Tax in New Mexico TaxValet New Mexico Sales Tax Rules The new mexico gross receipts tax rate in 2023 is 5.125%. This guide breaks down everything you need to know about new mexico’s sales tax, also known as gross receipts tax, from. New mexico does not have a sales tax. New mexico gross receipts tax rates & calculations in 2023. Since 2019, internet sales have been taxed using the statewide. New Mexico Sales Tax Rules.

From www.salestaxhandbook.com

New Mexico Sales Tax Rates By City & County 2024 New Mexico Sales Tax Rules It has a gross receipts tax instead. This guide breaks down everything you need to know about new mexico’s sales tax, also known as gross receipts tax, from. This tax is imposed on persons engaged in business in. Since 2019, internet sales have been taxed using the statewide 5.125% rate. New mexico gross receipts tax rates & calculations in 2023.. New Mexico Sales Tax Rules.

From www.formsbank.com

Tax Rate Table Form Based On Taxable State Of New Mexico New Mexico Sales Tax Rules This includes not only a marketplace seller, but a. This tax is imposed on persons engaged in business in. It has a gross receipts tax instead. New mexico sales & use tax rates change all the time and they differ depending on location too. Learn more about the local state sales tax rates. New mexico does not have a sales. New Mexico Sales Tax Rules.

From www.nmoga.org

NEW MEXICO TAX RESEARCH INSTITUTE STATE AND LOCAL REVENUE IMPACTS OF New Mexico Sales Tax Rules The new mexico gross receipts tax rate in 2023 is 5.125%. In new mexico, the seller must register, report and pay new mexico gross receipts tax. New mexico does not have a sales tax. Since 2019, internet sales have been taxed using the statewide 5.125% rate. This tax is imposed on persons engaged in business in. It has a gross. New Mexico Sales Tax Rules.

From freetrafficusamania.blogspot.com

List Of Sales Tax Rates By State free traffic usa New Mexico Sales Tax Rules The new mexico gross receipts tax rate in 2023 is 5.125%. Once you've successfully registered to collect new mexico gross receipts tax, you'll need to apply the correct rate to all taxable sales, remit. This includes not only a marketplace seller, but a. New mexico gross receipts tax rates & calculations in 2023. Since 2019, internet sales have been taxed. New Mexico Sales Tax Rules.

From thetaxvalet.com

How to File and Pay Sales Tax in New Mexico TaxValet New Mexico Sales Tax Rules Since 2019, internet sales have been taxed using the statewide 5.125% rate. It has a gross receipts tax instead. New mexico gross receipts tax rates & calculations in 2023. This includes not only a marketplace seller, but a. New mexico sales & use tax rates change all the time and they differ depending on location too. Learn more about the. New Mexico Sales Tax Rules.

From www.blue360media.com

New Mexico Jurisdictions New Mexico Sales Tax Rules Since 2019, internet sales have been taxed using the statewide 5.125% rate. New mexico does not have a sales tax. Once you've successfully registered to collect new mexico gross receipts tax, you'll need to apply the correct rate to all taxable sales, remit. This tax is imposed on persons engaged in business in. The new mexico gross receipts tax rate. New Mexico Sales Tax Rules.

From leticiawjoye.pages.dev

New Mexico State Sales Tax Rate 2024 Taryn New Mexico Sales Tax Rules It has a gross receipts tax instead. Since 2019, internet sales have been taxed using the statewide 5.125% rate. The new mexico gross receipts tax rate in 2023 is 5.125%. This includes not only a marketplace seller, but a. New mexico sales & use tax rates change all the time and they differ depending on location too. Learn more about. New Mexico Sales Tax Rules.